- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

What to Expect From Coterra Energy’s Next Quarterly Earnings Report

Valued at a market cap of $17.7 billion, Coterra Energy Inc. (CTRA) is a Houston-based independent oil and gas company. It operates across the Permian Basin, Marcellus Shale, and Anadarko Basin, producing oil, natural gas, and NGLs. The company is expected to announce its fiscal Q3 earnings for 2025 after the market closes on Monday, Nov. 3.

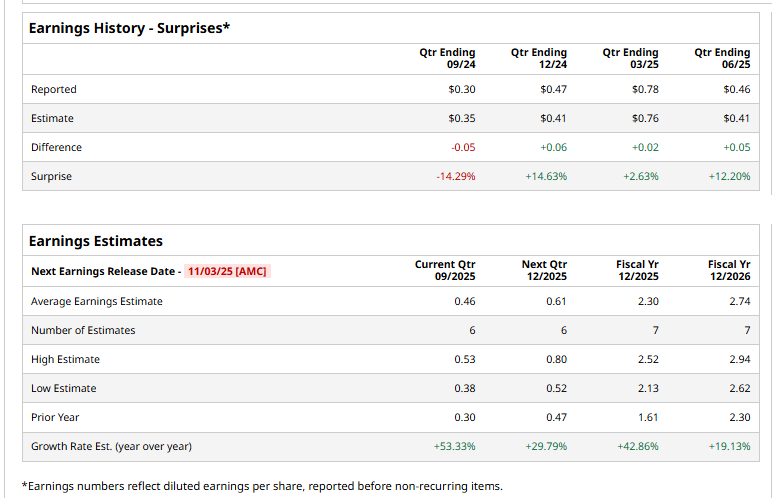

Ahead of this event, analysts expect this energy company to report a profit of $0.46 per share, up 53.3% from $0.30 per share in the year-ago quarter. The company has topped Wall Street’s earnings estimates in three of the last four quarters, while missing on another occasion.

For fiscal 2025, analysts expect Coterra Energy to report a profit of $2.30 per share, up 42.9% from $1.61 per share in fiscal 2024. Furthermore, its EPS is expected to grow 19.1% year over year to $2.74 in fiscal 2026.

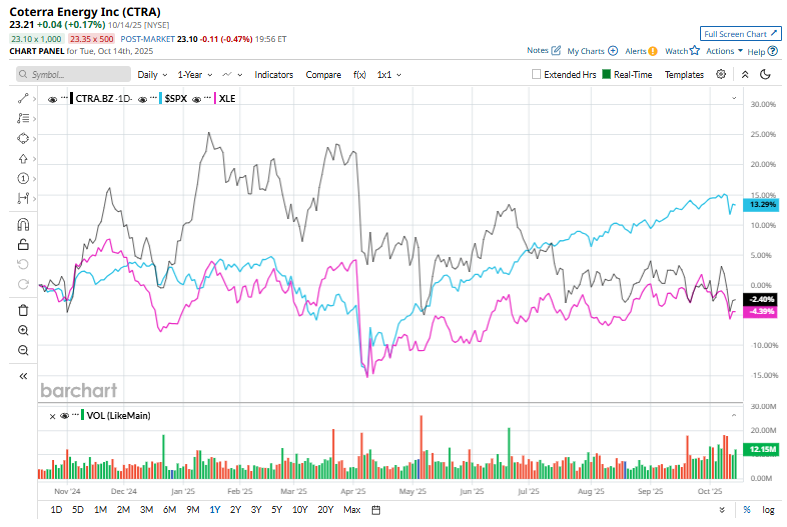

CTRA has declined 4.9% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 13.4% uptick and the Energy Select Sector SPDR Fund’s (XLE) 6.9% drop over the same time frame.

On October 10, Mizuho Securities analyst Nitin Kumar reaffirmed a “Buy” rating on Coterra Energy and set a price target of $33.

Wall Street analysts are highly optimistic about CTRA’s stock, with an overall "Strong Buy" rating. Among 24 analysts covering the stock, 16 recommend "Strong Buy," two indicate "Moderate Buy,” and six suggest "Hold.” The mean price target for CTRA is $32.83, implying a 41.4% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.