- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Earnings Preview: What to Expect From Altria Group’s Report

Valued at $109.1 billion by market cap, Altria Group, Inc. (MO) is a leading tobacco company headquartered in Richmond, Virginia. Altria owns prominent brands such as Marlboro, Black & Mild, and Copenhagen and operates through segments including smokeable products, oral tobacco, and wine.

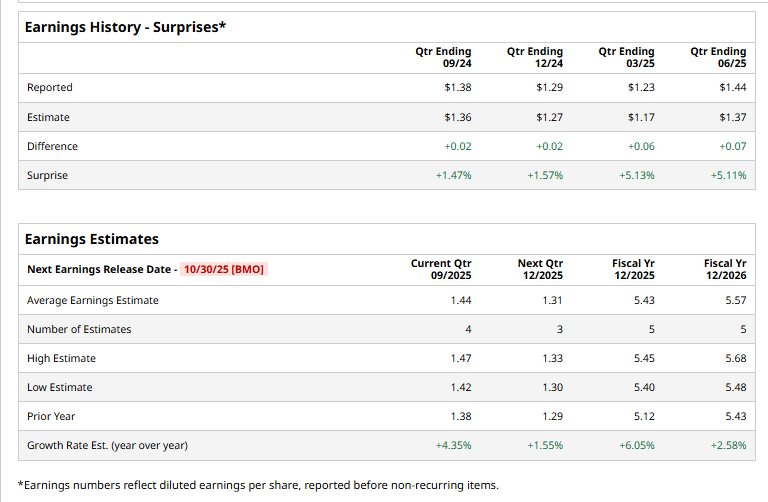

Altria Group is ready to release its third-quarter results before the markets open on Thursday, Oct. 30. Ahead of the event, analysts expect MO to report an adjusted EPS of $1.44, up 4.4% from $1.38 reported in the year-ago quarter. The company has surpassed Street’s bottom-line estimates in all of the past four quarters.

For fiscal 2025, MO is expected to deliver an adjusted EPS of $5.43, up 6.1% from $5.12 reported in fiscal 2024.

Over the past 52 weeks, MO shares have climbed 31.2%, outperforming both the S&P 500 Index’s ($SPX) 13.4% return and the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.5% fall during the same time frame.

On October 9, Bank of America Securities analyst Lisa Lewandowski reaffirmed a “Buy” rating on Altria Group. Following the news, MO shares climbed 1.3% in the next trading session.

The consensus view on Altria is neutral with a “Hold” rating overall. Of the 15 analysts covering the MO stock, four recommend “Strong Buy,” nine advise “Hold,” one advocates “Moderate Sell,” and the remaining analyst gives a “Strong Sell” rating. The stock currently trades slightly above its mean price target of $62.27.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.